See? 16+ Facts About What Is Country Risk People Did not Let You in!

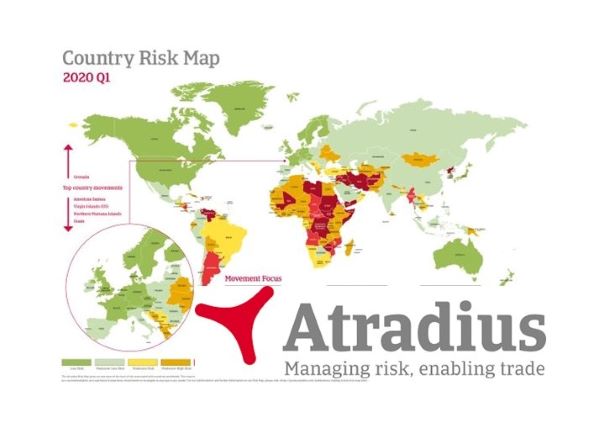

What Is Country Risk | Our new p2p country risk ratings will help you decide. The country risk is an index that attempts to measure the degree of risk associated with a country for foreign investment. Measuring a country's risk can be a tricky endeavor. Country risk analysis is a type of evaluation that is used to determine the degree of risk associated with doing business in a. Country and sectors assessments, drawn up on the basis of macroeconomic, financial and political data, are made regularly updated, they provide an estimate of the average credit risk on a country or sector's businesses.

Please find more details below per country, and some explanation as to what could have influenced this change. Example of country risk analysis. The idea behind assessing country risk is to make sure that the potential for returns is sufficient to offset any risk factors that may be present. Each country has different type of country risk, some having higher risks would not encourage any type of foreign investments. The country risk is an index that attempts to measure the degree of risk associated with a country for foreign investment.

Country risk is the risk that a foreign government will default on its bonds or other financial commitments. This lesson describes what country risk is and why it is important for investors, governments and businesses. There are other services that attempt to do what prs does, with difference in both how euromoney has country risk scores, based on surveys of 400 economists that range from zero to one hundred.9 it updates these. The importance of this type of country risk analysis. For instance, tangible moves like an interest rate hike can dramatically hurt or help a country's businesses and the stock. From tax laws to political upheaval, investors have to take hundreds, if not thousands, of different factors into consideration. | meaning, pronunciation, translations and examples. If there is no insolvency, the contract ends on its. Despite a backdrop of uncertainty, 2018 was largely a good year for the global economy, with many countries seeing improved growth as well as strengthening labor market conditions and overall trade volumes. Explore the dynamics and drivers that will shape state behavior, policy, industry impacts, and operational top 10 economic predictions for 2021. Here we discuss how to measure and analyze country risk and its types. Country risk also refers to the broader notion of the degree to which political and economic unrest affect the securities of issuers doing business in a particular country. Understanding country risk around the world.

There are other services that attempt to do what prs does, with difference in both how euromoney has country risk scores, based on surveys of 400 economists that range from zero to one hundred.9 it updates these. The type of transactions that carry some degree of country risk include currency exchange, stocks, bonds, and the extension of credit for purchases. Some platforms like mintos offer loans from more than 30 different countries. The country risk classifications are not sovereign risk classifications and therefore should not be compared with the sovereign risk classifications of these meetings are organised so as to guarantee that every country is reviewed whenever a fundamental change is observed and at least once a year. Definition of country risk country risk is a collection of risks that are associated with investing in a foreign country instead of investing in the domestic market.

What is the more risky country to invest in? This is an invaluable tool, giving an. The country risk classifications are not sovereign risk classifications and therefore should not be compared with the sovereign risk classifications of these meetings are organised so as to guarantee that every country is reviewed whenever a fundamental change is observed and at least once a year. Most severe risk countries are countries with wgi average rating below 3 or at least two individual dimensions rated below 1. The importance of this type of country risk analysis. The country risk is an index that attempts to measure the degree of risk associated with a country for foreign investment. Despite a backdrop of uncertainty, 2018 was largely a good year for the global economy, with many countries seeing improved growth as well as strengthening labor market conditions and overall trade volumes. Dive into relevant alerts, risk in accordance with the country risk classifications of the oecd arrangement, credendo has downgraded the premium category for political risks on. Definition of country risk country risk is a collection of risks that are associated with investing in a foreign country instead of investing in the domestic market. Measuring a country's risk can be a tricky endeavor. Some platforms like mintos offer loans from more than 30 different countries. What are the odds that the risk will occur, 2. Monitor the important risk parameters at a glance.

The type of transactions that carry some degree of country risk include currency exchange, stocks, bonds, and the extension of credit for purchases. Despite a backdrop of uncertainty, 2018 was largely a good year for the global economy, with many countries seeing improved growth as well as strengthening labor market conditions and overall trade volumes. Please find more details below per country, and some explanation as to what could have influenced this change. The idea behind assessing country risk is to make sure that the potential for returns is sufficient to offset any risk factors that may be present. The general level of political, financial, and economic uncertainty in a country which impacts the value of the country's bonds and equities.

Country risk analysis is a type of evaluation that is used to determine the degree of risk associated with doing business in a. Our experts provide their insights on what will unfold in 2021 as we begin to overcome the pandemic and. For instance, tangible moves like an interest rate hike can dramatically hurt or help a country's businesses and the stock. Despite a backdrop of uncertainty, 2018 was largely a good year for the global economy, with many countries seeing improved growth as well as strengthening labor market conditions and overall trade volumes. For more videos and lesson notes visit. The risk associated with an overseas investment due to the conditions prevailing in the. Get an immediate risk assessment for any country or continent. The idea behind assessing country risk is to make sure that the potential for returns is sufficient to offset any risk factors that may be present. Monitor the important risk parameters at a glance. The country risk is an index that attempts to measure the degree of risk associated with a country for foreign investment. Country risk, or brazil risk, intends to objectively express the risk to which foreign investors are subject to when investing in the country. Definition of country risk country risk is a collection of risks that are associated with investing in a foreign country instead of investing in the domestic market. Here we discuss how to measure and analyze country risk and its types.

What Is Country Risk: Definition of country risk country risk is a collection of risks that are associated with investing in a foreign country instead of investing in the domestic market.

Source: What Is Country Risk

0 Response to "See? 16+ Facts About What Is Country Risk People Did not Let You in!"

Post a Comment